What is a Renovation Loan?

The Renovation Loan is a type of home loan that is designed to provide a platform for homebuyers and homeowners to renovate or repair their residence and invest in their homes. Whether you are trying to renovate a primary residence, purchase a fixer upper investment property, or add a pool to your second home, Fairway has options for you!

Types of Renovation Loans?

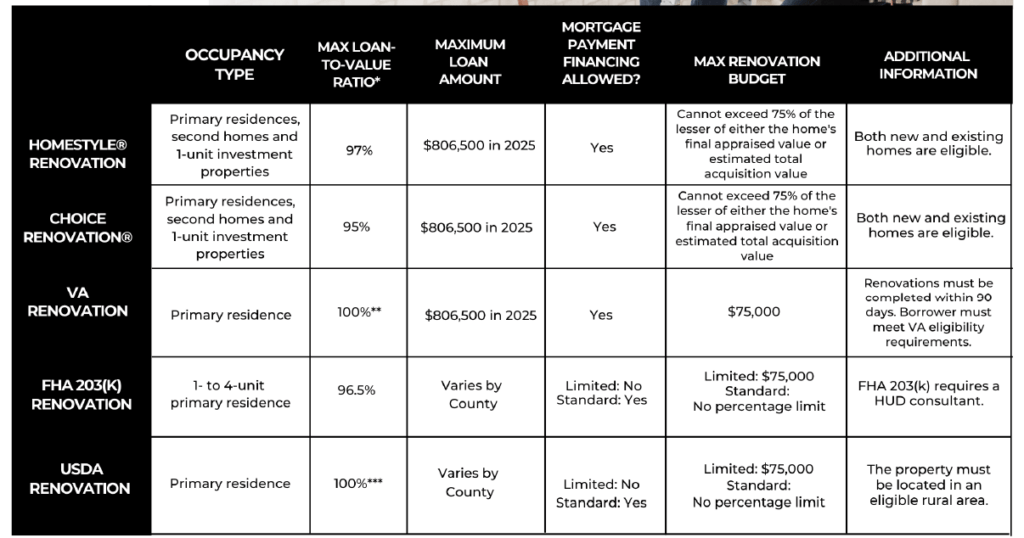

There are renovation loans available through Freddie Mac, Fannie Mae, USDA, VA and two programs available through FHA. Below is a chart with some requirements and conditions.

What down payment is required?

Down payments range per program but start as low as 3% down for primary residence purchases.

Can I use a renovation loan on a home I already own?

Yes, many people find themselves needing to refinance into a renovation loan in order to do much needed updates to their home such as adding an ADU, adding an additional bedroom, fixing a foundation, updating a kitchen, etc.

Frequently Asked Questions

What is the typical time frame to close a reno loan?

With the renovation loans having so many variables involved, it is best to prepare your borrower for a 45-60 day close.

Can I act as the general contractor?

The borrower CAN NOT act as their own General Contractor with any of the renovation programs. Not even if they are fully qualified and licensed.

Does my contractor need to be licensed?

Yes, the Contractor must comply with state and local municipality requirements.

What is the typical timeframe to get a contractor approved?

If we received all contractor approval docs that are fully complete and not expired, then we could complete a contractor approval within 24-48 hours. Otherwise, it will depend on how quickly the contractor can get us the required items.

Do any reno products allow for an investment property?

Fannie Mae and Freddie Macboth have renovation products offered by Fairway that permit the renovation of an investment property. Both programs allow for the purchase of a 1-unit investment property.

Would I be able to install a pool?

The FNMA Homestyle and FHLMC Choice programs will allow a borrower to install a new pool

Is there a MAX cap on the project costs?

- Homestyle and Choice: The renovation budget limited to 75% of the subject-to value

- Standard (K): There is no cap on the renovation budget. (FHA loan limits will apply)

- Limited (K): Total alterations must not exceed $75,000. This means that the bid and soft costs (contingency, permits, inspections, and title updates) cannot exceed this amount.

- VA: Total alterations must not exceed $75,000. This means that the bid and soft costs (contingency, permits, inspections, and title updates) cannot exceed this amount.

What if mold is currently at the property?

Mold Remediation is an eligible repair on the Standard K, Homestyle, and Choice products. We will require a mold inspection to ensure that our scope of work is remediating the mold from the property. Please note that this inspection will be required before an appraisal order. The contractor that is completing the remediation is required to carry a mold certification.

Can I complete any of the repairs themselves?

This would be considered self-help, and this is not eligible for any of the renovation products we currently offer.

Can we renovate manufactured homes?

- Homestyle and Choice Yes, the renovation budget cannot exceed the lesser of 50k or 50% of the after improved value.

- Standard (K) Manufactured homes are not eligible on the Standard K program.

- Limited (K) Yes, Total alterations must not exceed $75,000. This means that the bid and soft costs (contingency, permits, inspections, and title updates) cannot exceed this amount. No structural repairs are allowed.

- VA Total alterations must not exceed $75,000. This means that the bid and soft costs (contingency, permits, inspections, and title updates) cannot exceed this amount. No structural repairs are allowed. Work must also be completed within 120 days.

Can we use a Renovation loan to build an ADU?

An ADU is permitted to be constructed on a property as long as there is only one existing primary dwelling unit on the property. An ADU can be added to a primary dwelling or detached from a primary dwelling. It must provide for living, sleeping, cooking, and bathroom facilities and must be on the same parcel as the primary one-unit dwelling. ADUs are not permitted with a 2-4 unit dwelling. The local municipality must approve the ADU.

How long does it take for the funds to be available after the loan closes?

Loan Boarding - could take 48-72 hours from the time the loan funds.

Are dual-party checks allowed?

All checks are disbursed to be co-endorsed to both borrower and contractor.

How soon does my contractor get funds?

When you get paid depends on the loan type.

- Homestyle and Choice Once you make a verbal or written request to Draw Administration and the inspection is completed.

- Standard (K) Once you make a verbal or written request to Draw Administration and the inspection is completed.

- Limited (K) and VA

You will receive 50% of the total bid amount shortly after the close of the loan.

Can I get a material draw?

- Homestyle and Choice This must be requested from Draw admin after closing of the loan and cannot exceed 50% of material costs on bid.

- Standard (K) No, an exception for a material draw is for custom orders only and requires prior approval from Draw Administration.

- Limited (K) and VA No.

How many draws can I get?

- Homestyle and Choice: Up to 5

- Standard (K): Up to 5

- Limited (K) and VA: One per contractor

Will there be a holdback on the draws?

- Homestyle and Choice: No.

- Standard (K): Yes, a 10% holdback on all draws is released with the final draw.

- Limited (K) and VA: No.

My Contractor may have difficulty with proper bid formatting or Permit Certification; what can we do?

Using a Fairway bid template (Major and Minor) is preferred. If not using a Fairway template, please work with the renovation specialist to achieve an acceptable bid format which is required for lending and draw eligibility. Permit certification must be as accurate as possible.

Who can initiate a draw request?

The homeowner and/or contractor can initiate a draw request. It is important to communicate the progress on the approved scope and draw needs. If there are delays or changes, please make sure we know about them as soon as possible. The homeowner and contractor will be required to sign applicable draw forms as prepared by the draw administration (or the HUD consultant for 203K Standard). Any additional needs or turn times may be communicated through your Draw Administer.

Who can submit to receive a Material Draw Request?

If your project allows for a material draw, the homeowner or contractor can submit for an advance of funds on materials.

Note the following:

-

- Communicate the need for a material draw with Draw Administration.

- If there are custom or special order materials, Draw Administration may issue payment or deposit for materials. The supplier/vendor will be paid directly. Custom materials should be ordered in a timely manner to allow for fabrication and installation, avoiding any unnecessary delays.

- Invoices and/or receipts may be required to accommodate material draws.

- Communicate any needs with your draw administration contract.

When is the right time to request the Final Draw?

Upon receipt of satisfactory inspection results, clear title, and completed final draw forms, the draw administration will issue the final checks.

-

- All items on the signed original bid/contract are 100% complete, including any approved changes.

- If permits were required, then permit inspections have passed and are finalized.

- The draw administration will require records.

- Anything that has been moved during construction has been replaced or put back (i.e. fixtures, gutters, door knobs, trim, etc.)

What if I run into unforeseen repairs or cost overruns?

If the borrower runs into cost overruns or unforeseen repairs, the borrower can access their contingency reserves that were financed into their loan by requesting a change order via their draw admin specialist. All parties involved in the transaction must sign off on the change order.

What is a Change Order, and why are they important?

A Change Order is a document that records an amendment to the original construction contract.

-

- A Change Order is valid only if it is signed by the homeowner, contractor, draw administrator (lender-authorized agent), and HUD consultant, when applicable. it must also be accompanied by a separate invoice. A verbal agreement is not valid and will not allow access to the contingency funds.

- A change order must be signed and approved by all parties before the newly added repairs are started. It may not be approved or covered by contingency reserves if it's sent to draw administration after the repairs are made.

If there are no available reserves, or you neglect to get prior approval, that work becomes a separate contract between the homeowner and contractor, and they'll have to make a separate arrangement for payment.

Is it possible to change my Contractor after work has started?

The homeowner/contractor relationship is a commitment, so you should do everything in your power to maintain that contract. if disputes arise, the draw administration should be notified early on. If it is clear that there's an impasse, it may be time to release the contractor and hire another.

Important Note: if there is a change of contractors, the homeowner must adhere to the following steps to release a contractor.

-

- The homeowner must deliver a signed and dated termination letter expressing that the contract and contractor are terminated. The letter doesn't have to specify a reason.

- An inspection is required to identify the current status of the scope and final payment due to the contractor.

- The exiting contractor must sign an unconditional lien waiver. For cases where there is no additional payment, the contractor may sign a $0 lien waiver.

The draw administration will provide support during the time of transition and assist in attempts to collect required waivers.

Is it possible to request an extension of completion?

Delays happen - and for a variety of reasons. We're here to help!

Consideration for an extension of completion may be granted. The homeowner is responsible for notifying the draw administration of any delays. A request for completion extension will be documented through a change order form and must include the reason(s) for the delay, as well as the new completion date. Extensions may be approved in 30-day increments. In some cases, additional extension periods may be considered for approval.

The draw administration may contribute efforts to follow up and provide proactive assistance in attaining the extension request on the file and ensuring the rehabilitation loan remains compliant.

IMPORTANT NOTE: A failure of the project to be completed in the allotted time, or failure to submit a request for an extension, will result in a default under the terms of the rehabilitation loan agreement, regardless of timely payment history. Under default, the mortgage loan servicer may exercise any and all remedies available to it under the terms and loan documents, up to and including foreclosure.

What is needed for the final Draw Request?

Once the draw admin receives a final inspection, clear title, and completed draw forms, the draw will be able to disburse the final disbursement.

At The French Team, we specialize in Renovation Loans and can help evaluate your options to find a solution for you. Contact us today for all your home loan needs.