StartSmart and Down Payment Assistance

ADFA- StartSmart and Down Payment Assistance

I speak to clients on the daily about the hurdles of home ownership versus renting. They often come to me after struggling to find a rental, being kicked out due to a property ownership change, or after applying for multiple homes and getting denied for rentals. What most do not know when they come to me is that buying a home does not have to be hard. Often, the requirements are a lot like renting. Most major rental companies in my area want a 640-credit score, gross income at least 3x your rent, and low overall debt. They usually charge a deposit at one months rent and the first month up front. If you can qualify to these rental standards, then you possibly qualify for a mortgage.

You are probably thinking, ‘yeah, but what about the down payment’?

Great question! Here comes the Down Payment Assistance program Start Smart to the rescue!

StartSmart is one of Arkansas Development Finance Authority housing programs. This state program is designed to help promote homeownership in a way that is easily accessible and feasible for Arkansas families. With this program you can finance a home through FHA, VA, USDA, or Conventional (Freddie Mac) financing at lower than market rates and finance up to $15,000 on a second mortgage to cover your down payment and some of your closing costs! If structured correctly, I have had clients come to closing with $0 paid out of pocket.

What Credit Score do I need?

ADFA requires a 640 mid credit score AND an approval through the Automatic Underwriting System.

Do I have to be a First Time Homebuyer?

The program requires you and your spouse be a first-time homebuyer- defined as someone who has not owned a PRIMARY RESIDENCE in the last three years. If you are a veteran, you can apply for a one-time exception to this rule. If you owned a property but it has only been used as an investment property, then you still qualify. This rule also does not apply to targeted counties. If you are purchasing in a targeting county below- you do not have to be a first-time homebuyer.

What counties are targeted?

Bradley, Calhoun, Chicot, Clark, Cleburne, Columbia, Conway, Crawford, Crittenden, Cross, Dallas, Desha, Drew, Jefferson, Lafayette, Lee, Lincoln, Madison, Mississippi, Monroe, Nevada, Ouachita, Perry, Phillips, Prairie, Scott, Searcy, St. Francis, White, Woodruff

Does this program have a purchase price limit?

For 2025 it is $500,000.

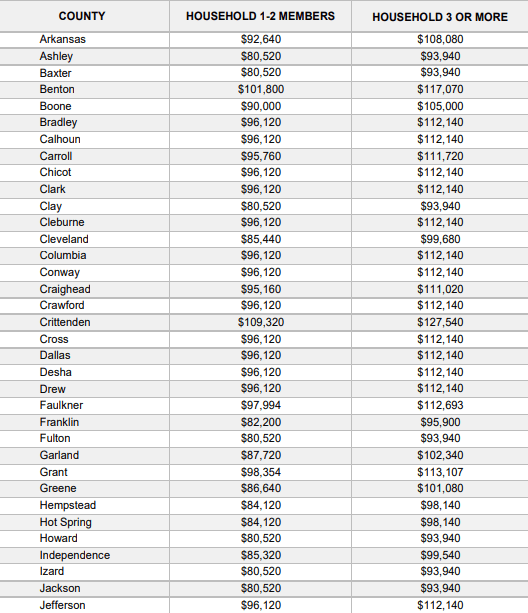

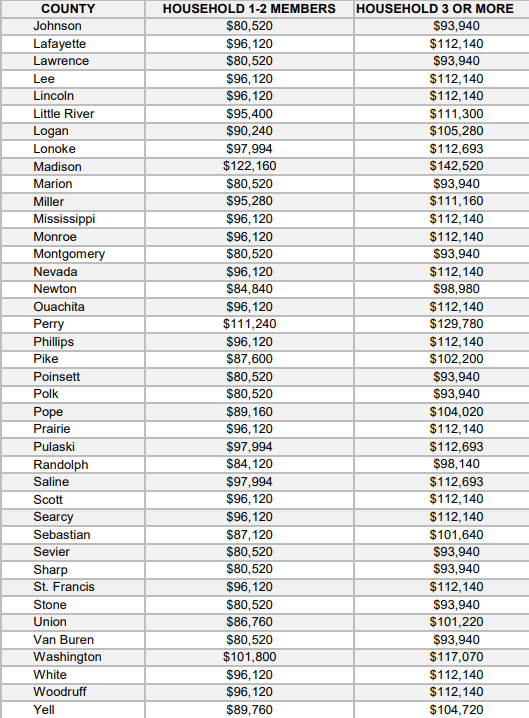

Does this program have income limits?

This program uses household income defined as any adult in the home over the age of 18 years old. The total household limit can be found below per county and household size.

What kind of property is eligible for this program?

One Unit Single Family Residences, Townhouses, Condos, Manufactured Homes, Duplexes (non-targeted counties the duplex must be at least 5 years old, target counties it can be newer). Homes cannot be on more than 5 acres.

What documents will I need to provide?

- Most recent 30 days paystubs and a verification of employment

- Proof of any other income

- W2s or 1099s for two years

- 1-2 years tax returns

- Child Support agreements and pay history

- DL

- Bank Statements for two months

- Other documents may apply

How do I apply?

You can follow this link to apply today!